Medicare in Texas

The federal government provides affordable health insurance to eligible seniors through the Medicare program. This benefit is available to seniors aged 65 and over and adults with qualifying disabilities. In 2020, 4.25 million Texas seniors participated in Medicare, with around 1.7 million choosing to get their benefits through Medicare Advantage, sometimes called Part C. In 2020, the federal government spent $829.5 billion on Medicare, or $13,550 per enrollee.

Original Medicare is organized into three major parts, known as A, B and D. Part A pays the majority of the cost for inpatient stays in the hospital. Because seniors with enough work credits get Part A coverage with no monthly premium, eligible seniors are automatically enrolled in it. Part B is Medicare’s outpatient benefit. For a single monthly premium, Part B pays for outpatient care, office visits, transportation for medical trips and some medical equipment and supplies. The premium amount in 2022 for Part B is $170.10. Part D covers most of the cost of prescription drugs. These plans are available in a wide variety of options, which makes it difficult to generalize about coverage limits and monthly premiums.

Part C is another way for seniors to get their Medicare benefits. Also called Medicare Advantage, Part C plans are offered in each state through private insurance companies. Part C plans fold Part A and B coverage together into a single premium plan. Most plans also include a prescription drug component and some extra coverage, usually dental, vision and hearing. Most Medicare Advantage plans have annual out-of-pocket limits, which make them an appealing option for seniors on fixed incomes.

This guide offers information about Medicare in Texas. It includes information about how to customize coverage and a list of resources that can help with making a well-informed decision about benefits.

Website: https://www.payingforseniorcare.com/medicare/texas

Options for Medicare Coverage in Texas

Most of the seniors who qualify for Medicare coverage opt to participate in one of two ways, Original Medicare or Medicare Advantage. Seniors in Texas have a choice in how to build their coverage to best meet their unique health care needs. In addition to the central Medicare benefit offered by the federal government, there are also private plans and supplemental plans to choose from.

Original Medicare (Parts A & B)

Original Medicare is administered by the Centers for Medicare & Medicaid Services and is open to seniors aged 65 and over, along with those under 65 years old, but with certain disabilities or end-stage kidney diseases. It includes two parts. Part A covers inpatient hospital care, nursing home and skilled nursing care, hospice and home health care. Part B, or medical coverage, pays for medically necessary goods and services such as durable medical equipment, mental health services and emergency medical transportation.

Unlike most private Medicare plans, Original Medicare’s provider network isn’t limited to the beneficiary’s geographic region, making it easier to obtain services while traveling within the country. In most cases, Medicare doesn’t pay for health services the individual receives outside the United States.

Under this program, seniors pay for services as they receive them. They must pay an annual deductible, which is $1,556 for Part A and $233 for Part B in 2022. After they’ve paid this amount, Medicare covers all eligible services at 80%. Beneficiaries pay the remaining 20% out of pocket.

Who Should Consider Original Medicare

Original Medicare may be a good option for those who:

- Travel frequently within the United States

- Don’t need extra benefits such as home-delivered meals and coverage for over-the-counter medication

- Want to choose their own prescription drug coverage

Medicare Advantage (Part C)

Medicare Advantage is a popular alternative way many seniors choose to receive their Medicare benefits. Part C plans are managed by private insurance providers on a state-by-state basis. Medicare Advantage plans are required to meet certain minimums for coverage, though they are free to offer expanded coverage. Authorized Medicare Advantage plans combine nearly all of the benefits included under Parts A and B, except for hospice care, which is provided under Part A, regardless of other coverage. Medicare Advantage plans have a lot to offer participants, including some benefits not covered by Original Medicare and annual out-of-pocket caps. Many plans also offer vision, dental and hearing services, wellness programs and credits for non-emergency medical transportation. Some plans even include assistance with over-the-counter medications.

Like other types of private insurance, Medicare Advantage plans are mostly organized into four main categories. These are Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Private Fee-for-Service (PFFS) plans and Special Needs Plans (SNP). These plan types vary in their eligibility standards, premium costs, deductibles, network structures and rules for referrals to specialists.

Who Should Consider Medicare Advantage

Medicare Advantage can be a good choice for seniors who:

- Need to limit out-of-pocket expenses

- Prefer additional benefits such as prescription drug coverage and dental care

- Are generally healthy so may benefit from lower premiums

- Would like to have a managed care plan

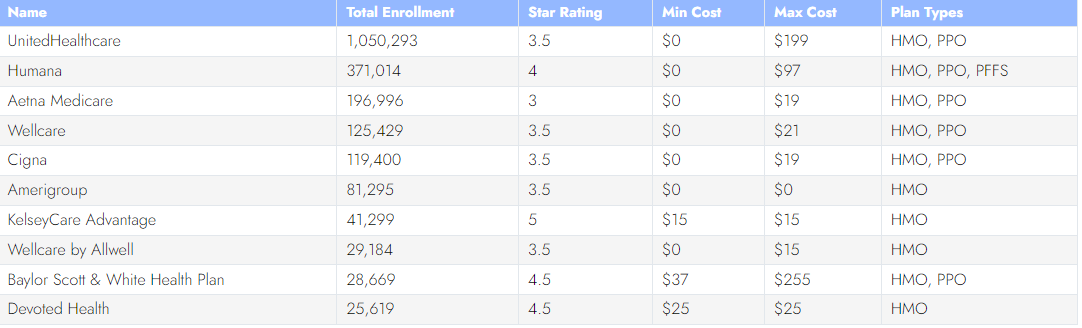

The Top 10 Medicare Advantage Plans in Texas

Seniors in Texas can choose between a large number of highly rated Medicare Advantage plans. The table below lists some of the top Medicare Advantage providers, judged by the number of currently enrolled participants. It includes the range of prices across plans that are current as of April 2022. More information on Medicare Part C plans is available on the Medicare Advantage Plans in Texas page.

Medicare Prescription Drug Coverage (Part D)

Original Medicare doesn’t pay for most prescription drugs through Part A or B coverage. Instead, seniors purchase separate prescription drug policies, also called Part D coverage. Medicare contracts with private health insurance companies to provide this coverage. There are multiple plans to choose from with varying monthly premiums, which beneficiaries pay in addition to their Original Medicare premiums. While seniors don’t have to purchase prescription drug coverage when they’re first eligible for Medicare, not obtaining this coverage at this time may result in late enrollment penalties they pay for as long as they have Medicare if they enroll later.

Each prescription drug plan has its own formulary, or list of covered drugs. Formularies are typically split up into tiers. The tier a medication is in determines how much the insurance company pays and how much the beneficiary pays for it. Lower-level tiers are usually made up of generic and low-cost brand name drugs, while higher tiers are composed of more expensive brand name and specialty drugs. In most cases, the lower the tier, the lower the policyholder’s cost-sharing responsibility.

Who Should Consider Medicare Prescription Drug Coverage

Seniors who may benefit from prescription drug coverage include those who:

- Currently take prescription medication or expect to in the future

- Want to avoid late enrollment penalties

- Want to reduce out-of-pocket prescription drug expenses

Medicare Supplement Insurance (Medigap)

While Original Medicare provides coverage for many medical costs, seniors may still have significant out-of-pocket expenses. These may include copays, coinsurance and deductibles. Seniors may be able to reduce their cost-sharing obligations by purchasing a Medigap plan. These plans can only be used with Original Medicare. It’s illegal for private insurance companies to sell Medigap plans to those with Medicare Advantage plans.

For more information on Medigap plans, seniors can refer to the Best Medicare Supplement Companies of 2022 page.

Who Should Consider Medicare Supplement Insurance

Good candidates for Medigap may be those who:

- Have ongoing health issues and expenses

- Travel overseas often

- Want to access an expanded network of health care providers

- Expect to need health services not covered by Original Medicare

Medicare Resources in Texas

It can be a challenge to navigate the complex environment of Medicare options in Texas. Fortunately, seniors in the Lone Star State have access to several programs and agencies that can help them find the best care for their needs. Through these resources, Medicare beneficiaries can get advice, referrals and one-on-one assistance with finding and applying for Original Medicare, Medicare Advantage, Medigap and prescription drug coverage.

Texas Health Information, Counseling and Advocacy Program

The Texas Health Information, Counseling and Advocacy Program (HICAP) offers advice and education on Medicare, Medicaid and private health insurance from trained volunteer counselors. Seniors can reach out to the program to get answers about eligibility, the application process and whether they qualify for a Medicare Savings plan. Volunteers can also provide information about secondary benefits, such as prescription drug coverage, and legal assistance with appeals.

Area Agencies on Aging

The 28 Area Agencies on Aging in Texas are available to help individuals aged 60 and over find specialists who can help them find health insurance information and get assistance applying for Medicare. Information is also available regarding other insurance options and non-health care matters, such as civil legal assistance. Agencies are apportioned by state region and serve seniors in their local area.

Texas Department of Insurance

The Texas Department of Insurance is a state agency that offers professional and impartial advice for seniors who are looking into their health insurance options. Staff at the Department can help seniors by providing free information, advice and referrals. The Department’s website also has information about current insurance issues in the state, including public records and complaints, fraud alerts and other pressing matters affecting seniors in Texas.

Texas Government Affairs and Advocacy

The Texas Government Affairs and Advocacy Agency advocates for seniors seeking high-quality health coverage and effective health care. Agency staff interact with leaders, agencies, employees and other stakeholders in Texas health care to develop a clear public record of the current state of health care in the state. Advocates lead policy initiatives and promote senior health issues through direct contact with legislators and by building connections between interested groups. Individualized counseling and information for seniors are available from agency HICAP counselors familiar with Medicare and other insurance programs.

Senior Medicare Patrol

The Senior Medicare Patrol (SMP) is a nonprofit, volunteer-based program that helps seniors prevent fraud and other common forms of victimization with information and up-to-date alerts. The team can help seniors understand the items listed on their medical bills and spot suspicious charges or unauthorized services. SMP can also, in some cases, identify errors and other inaccuracies in care delivery.

Social Security Administration

The federal Social Security Administration administers Medicare and sets standards for Medicare Advantage and Medigap providers. The SSA’s online portal is an ideal resource for seniors in Texas who need to file an application for coverage, get replacement cards or find information about enrollment periods and late penalties. The SSA’s online portal has a tool seniors can use to determine whether they meet the standards for financial assistance and Medicare Savings plans.New Paragraph